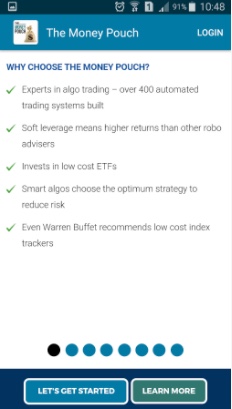

In a latest development the popular Hudson James Investment Management professionally launched The Money Pouch, a wealth management service for high net worth individuals. It actually charges zero annual management fees for all accounts investing over $250,000. The smaller accounts are available with a low annual management charge of 0.04% per month. Many people are curious to know about Benefits of Using The Money Pouch App.

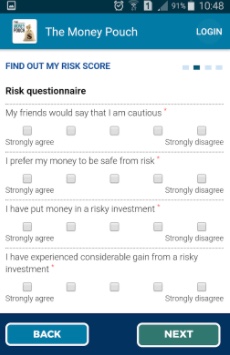

The app use modern portfolio theory, automated computer trading algorithms, frequent rebalancing and risk profiling to maximise returns on your money. It professionally manages your account with taxes in mind since minimising your taxes is a key part of maximising your long-term investment returns.

There is no lock-ins which means you could cash out of your investment portfolio at any time. Moreover you could top up your investment account at any time, especially to take advantage of dollar cost averaging and value investing if stock market prices begin to fall. Any dividends paid out would be automatically be reinvested in the strategy.

Their service primarily relies on consistent and overwhelming research, which illustrates that index funds significantly outperforms actively managed portfolios the majority of the time. They also use ETFs that track indexes for the major asset classes in our portfolios. Each ETF is selected by their investment research team based on its relative cost, risk/reward return, tracking error and market liquidity.

The Money Pouch is hoping to attract quality investors with a low annual management fee, instead aligning their interests with clients with their performance fee. It uses algorithms which work on sophisticated momentum strategies to invest in the best and safest ETFs in USD. The investment portfolio is rebalanced approximately once per month, but has human management oversight to step in if stock markets start to head south.

Roboadviser is also different where it could selects from a wider range of ETF’s than most roboadvisors. Major investments houses are stuck to investing invest only in their own range of ETF funds ranges. The Money Pouch might invest in any ETF offered by any fund house listed on a major stock exchange, allowing it freedom of choice and independence. It also provides distinct advantage in not being tied down to investing own products, making it more independent of their investment selection.

Hudson James Investment Management has wholly appointed over 400 automated trading systems for some of the largest financial institutions around the globe. It uses a computer algorithm which eliminates emotion from the investment process. Even more the computer program ranks ETF’s based on a number of technical indicators and then selects the best ETF’s to hold for the subsequent month. By this method it almost reduces risk and improves returns for clients. These rebalanced ETF strategies seek to make positive returns in rising, falling and range-bound markets

The Money Pouch is focusing on soft leverage to target higher returns than most roboadvisers. The company has been testing their strategies such as the conservative, balanced and adventurous strategies which had consecutive positive months for the last nine months. As effective result the Money Pouch’s three ETF strategies have all beaten the 60% equity 40% bond mix of a typical ETF retirement portfolio since launch.

The back-tested ETF solutions and the live results from the last nine months could be actually seen on the website. It is narrated that all three strategies have the high ability to hold equities, gold or treasury ETF’s. The proportions invested in each asset class would vary depending on the results produced by the algorithms. The strategies could also allow for a move into cash in the event of a prolonged market downturn.

The Money Pouch specialises in managing ETF strategies. Hudson James is the asset manager for the Money Pouch and primarily holds Separately Managed Accounts (SMA’s). These segregated accounts offer the individual investor complete transparency, flexibility and protection. In addition the client’s assets are therefore ring-fenced and protected by a deposit insurance scheme.

It is conveyed that the minimum investment is only $10,000 which lowers the entry barriers and offers access to a wider, global audience of investors. Altogether The Money pouch is top online wealth service which buys stock and bond ETFs on your behalf automatically. The users could download this app from App Store and Play Store.

You could also watch FREE Masterclass video where you can learn all about ETF investing: